It goes without saying — but, here we say it — that last week was a really bad week for PG&E. Surprising? No, it was a runaway train wreck apt to happen, particularly as PG&E’s liabilities for the San Bruno gas line explosions and wildfires over the past two years amplified. A few months ago — pre-PGE bankruptcy — California PUC Chairman Michael Picker opined, “PG&E is too big to succeed.”

What’s next for PG&E? Myriad opinions have been tendered over the past week. While there’s no consensus, one thing is clear: PG&E’s rates are going to increase; we, the ratepayers, will bear part of the burden.

There’s also consensus that those of us who have solar (300,000+ net-metering customers in PG&E territory) are safe. PG&E cannot arbitrarily change current net-metering rules, as established by the PUC. Furthermore, solar/distributed generation is part of the solution, not an element of the problem. When property owners generate electricity via solar panels, energy use is centralized and the burden on the grid is mitigated. Solar is safe and secure.

Over the past week, we’ve chatted with a dozen or so prospective solar homeowners. Why solar, why now? we ask. Almost verbatim responses: Now that PG&E is going into bankruptcy and rates are destined to rise, the time seems right. (Secondarily, several homeowners have shared they view solar as a sage investment vis-a-vis volatile financial markets; solar generates a ~15% annual yield.)

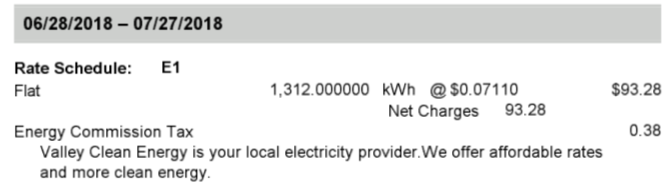

While PG&E’s future is unknown, solar provides certainty for homeowners. Today, PG&E’s baseline (“Tier 1”) electricity rate is 22 cents per kWh. For Repower homeowners, the amortized cost to generate solar electricity is ~8 cents per kWh. With PG&E, you are at risk of (and have no control over) future rate increases. When you go solar, you lock in your price of electricity for 25 years.

And, the sun always rises :)